If you are being taken fully to court for debt

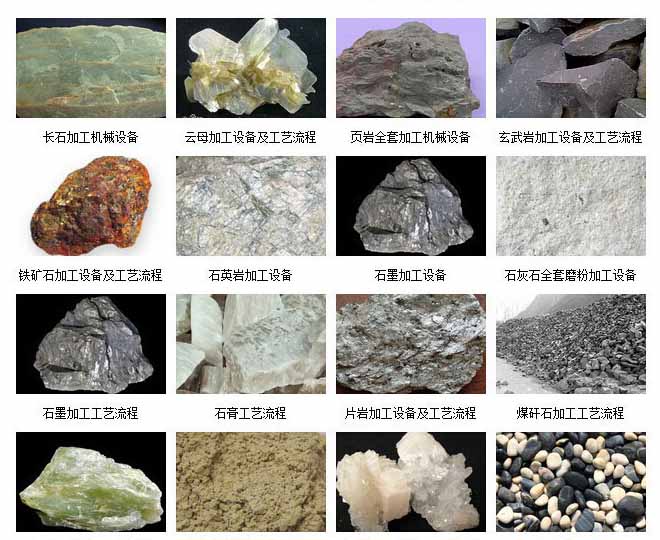

可以点击在线客服或者拨打热线电话:400-655-9906

The individuals your debt cash toвЂcreditors’ are called. In the event that you owe cash and also you do not repay it your creditor usually takes one to court.

You might be able to stop them taking you to definitely court in the event that you consent to spend a number of the money-back.

Respond to your claim as soon as possible, also in the event that you disagree you borrowed from your debt.

In the event that you don’t answer, you may be taken fully to court for the financial obligation you don’t owe. It will be harder to challenge your choice during this period and may find yourself costing you cash to improve it. As long as you’re responding you can even always check your options for getting away from financial obligation.

If you’re taken to court, a court purchase should be made. This can state exactly how much you’ll want to spend so when you will need to spend by.

In the event that you can’t manage to pay you really need to nevertheless make an offer to settle a few of the financial obligation. Also an offer of £1 is better than offering nothing.

When you yourself have other debts

Always check your creditor has delivered you the documents that are right

Your creditor has got to deliver you the right papers before using one to court. Whether they haven’t, you could be in a position to challenge the claim.

Once you borrowed the funds you would have been expected to signal an understanding which claims everything you along with your creditor accept.

For credit agreements that are most, you’ll be included in the customer Credit Act. If you’re uncertain, determine if your credit contract is included in the buyer Credit Act.

Should your contract is covered by the customer Credit Act, your creditor must follow all 3 actions of this procedure before using you to court for financial obligation.

Your creditor must give you a:

- standard notice

- page of claim

- claim pack

In the event your contract is not included in the buyer Credit Act, your creditor doesn’t need to deliver you a standard notice. Your creditor will nevertheless give you a page of claim and a claim pack.

You might be able to challenge the claim against you if you feel your creditor hasn’t acted properly. For instance, if the creditor hasn’t warned you associated with the financial obligation or they’ve began legal action too quickly. You really need to speak to your nearest people information.

1. Default notice

The standard notice includes information on just what re re payments you missed and just how very long you must spend. Your creditor needs to offer you at the least 14 days  . If you result in the missed re re payments, your creditor won’t simply simply simply take any further action.

. If you result in the missed re re payments, your creditor won’t simply simply simply take any further action.

The standard notice also incorporates reality sheet through the Financial Conduct Authority which describes your liberties.

At the top of the page that is first should state:

2. Letter of claim

Your creditor has sent you a вЂletter of claim’ you 30 days to reply because they want to start legal action.This gives.

The page of claim needs to have include:

- a вЂreply form’ – utilize this kind to express you owe the debt or say you need more time if you agree

- a вЂstandard economic declaration’ – utilize this to produce an offer of re re payment if you fail to manage to spend your debt in complete

- information on advice organisations

- an information sheet describing the manner in which you as well as your creditor should work

3. Claim pack

They can start legal action against you if you and your creditor didn’t reach an agreement. If for example the creditor has begun appropriate action, the court may have delivered you a вЂclaim pack’.

You’re given 14 days to answr fully your creditor through the time you get the claim pack.

You need to check always they papers are genuine. The proper execution name ought to be at the very top and also the type quantity into the base right part.

- вЂN1: Claim form’ – this informs you exactly how much your debt and just exactly what your debt is

- вЂN9: Response pack’ – utilize this to tell the court you’ll need 30 days to get ready your defence in the event that you disagree using the financial obligation

- вЂN9A: Admission (specified amount)’ – utilize this to tell your creditor you consent to all or element of a financial obligation, and work out an offer to cover

- вЂN9B: Defence and counterclaim’ – utilize this to guard a claim in the event that you think your creditor owes you money if you disagree with the debt, or make a counterclaim

If you have gotten a County Court Judgment

Should this be the document that is first’ve got in regards to the financial obligation, you are in a position to connect with cancel it – this will be called вЂsetting aside’ the judgment.

Cancelling a claim may be complicated – you speak to your nearest Citizens information for assistance.

Replying to your creditor

You ought to respond to a claim at the earliest opportunity. List of positive actions relies on in the event that you:

- agree you borrowed from component or every one of the financial obligation

- disagree you borrowed from the financial obligation

In the event that you move house

It’s vital that you let your creditor understand you don’t miss letters from your creditor if you change address so. Without you knowing if you don’t, your creditor might start legal action.